Top 10 Finance Management Modules in 2025 — How BNTM HUB Compares

A Finance Management Module is crucial for businesses to handle accounting, cash flow, budgeting, invoicing, and financial reporting. Choosing the right module ensures accurate financial management, compliance, and better business decision-making.

In this guide, we explore the top 10 finance management modules in 2025 and explain how BNTM HUB Finance Management Module stands out, especially for SMEs and institutions in the Philippines.

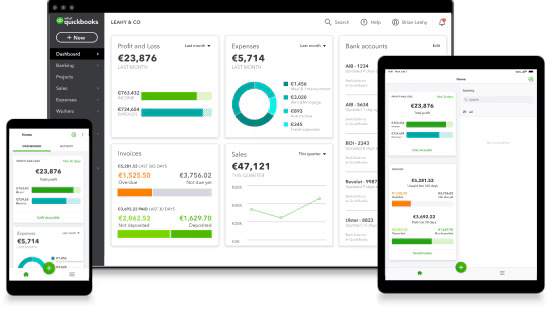

1. QuickBooks Online

Widely used accounting software with cash-flow management, invoicing, payroll add-ons, and integration with eCommerce/retail tools — friendly for startups and small businesses.

Best for: Small to medium-sized businesses

QuickBooks offers cloud-based accounting with invoicing, expense tracking, payroll, and bank integrations. Its ease of use and extensive ecosystem make it a top choice globally.

2. Xero

Cloud-based accounting platform popular with SMEs and startups for real-time financials, bank reconciliation, invoicing, cash-flow tracking, and reporting. It integrates with many apps and is supported in the Philippines via partner networks.

Best for: Small businesses and remote teams

Xero provides online accounting with real-time collaboration, bank reconciliation, and multi-currency support. It’s popular for cloud-based accounting efficiency.

3. SAP Business One

An ERP solution with strong accounting and financial modules integrated with operations, inventory, and analytics — ideal for companies scaling beyond basic accounting systems.

Best for: Mid-sized enterprises

Provides comprehensive finance, inventory, and operations management. Suitable for companies needing ERP integration alongside finance management.

4. Oracle NetSuite

A leading enterprise ERP with comprehensive financial management capabilities — general ledger, AP/AR, budgeting, revenue recognition, and financial reporting — suitable for mid-to-large businesses.

Best for: Large enterprises

Oracle NetSuite is a full ERP system with advanced financial reporting, global compliance, and multi-subsidiary management for complex organizations.

5. Zoho Books

Part of the Zoho ecosystem with invoicing, expense tracking, GST/VAT support, online payments, and reporting. Good fit for small-to-medium businesses needing scalable cloud finance tools.

Best for: Small businesses looking for integrated finance tools

Zoho Books offers accounting, invoicing, tax compliance, and automation within a simple interface, ideal for growing companies.

6. Sage Intacct

Offers robust financial management tools including multi-currency accounting, budget control, and bank reconciliation, with versions suited for SMBs to medium enterprises.

Best for: Mid-sized companies and cloud ERP users

Sage Intacct focuses on financial consolidation, multi-entity management, and automation of complex accounting workflows.

7. Wave Accounting

Wave Accounting is a free, cloud-based accounting software for small businesses, offering invoicing, expense tracking, and basic accounting. Its edge is cost-effectiveness and ease of use, making it ideal for startups and small businesses with simple accounting needs.

Best for: Freelancers and micro-businesses

Wave is a free accounting tool for invoicing, expense tracking, and basic financial management, making it ideal for small-scale operations.

8. FreshBooks

FreshBooks is an accounting and invoicing platform tailored for small businesses and freelancers. Its edge is user-friendly invoicing, time tracking, and expense management, helping businesses save time on financial tasks.

Best for: Service-based businesses

FreshBooks simplifies invoicing, time tracking, and expense management with cloud accessibility and mobile-friendly features.

9. TallyPrime

TallyPrime is a comprehensive accounting and ERP software used by businesses to manage accounting, inventory, payroll, and compliance. Its edge is powerful reporting and scalability, suitable for growing businesses and complex financial operations.

Best for: SMEs in Asia

TallyPrime offers accounting, inventory, GST compliance, and reporting features. It’s widely adopted in the region for local financial regulations.

10. BNTM HUB Finance Management Module

The BNTM HUB Finance Management Module centralizes accounting, invoicing, payment tracking, and financial reporting within one platform. Its edge is seamless integration with other BNTM HUB modules like CRM, HR, and Project Management, providing a unified view of finances and business performance while streamlining financial workflows.

Best for: Philippine MSMEs, institutions, and multi-location businesses

BNTM HUB’s finance module is part of an integrated business ecosystem that connects finance, POS, inventory, and e-commerce. This ensures real-time reporting, compliance, and streamlined operations without the need for multiple platforms.

- Unified Platform: Integrated with POS, inventory, and e-commerce modules.

- Local Compliance: Philippine-specific tax and accounting support.

- Scalable: Suitable for growing MSMEs and multi-site operations.

Comparison Table

| Finance Module | Best For | Key Strength |

|---|---|---|

| QuickBooks Online | SMBs | Ease of use, cloud accounting |

| Xero | SMBs, remote teams | Real-time collaboration, multi-currency |

| SAP Business One | Mid-sized enterprises | ERP integration, financial control |

| Oracle NetSuite | Large enterprises | Global compliance, advanced reporting |

| Zoho Books | SMBs | Automation, invoicing, tax compliance |

| Sage Intacct | Mid-sized companies | Financial consolidation, multi-entity |

| Wave Accounting | Freelancers & micro-businesses | Free, basic accounting |

| FreshBooks | Service-based businesses | Invoicing & time tracking |

| TallyPrime | SMEs in Asia | Regional compliance, inventory integration |

| BNTM HUB | MSMEs & institutions | All-in-one platform, local compliance, POS/E-commerce integrated |

How to Choose the Right Finance Management Module

- Integration with POS, inventory, and e-commerce systems

- Automation for reporting and tax compliance

- Scalability for business growth

- Cost and total value of ownership

- Local support and compliance (especially for Philippine businesses)

Final Thoughts

While global finance platforms offer strong features, BNTM HUB Finance Management Module provides a localized, integrated, and scalable solution for Philippine businesses. It reduces operational complexity, connects all business functions, and supports smarter financial decision-making.

Shortlisted here: https://www.bentamo.site/register/